The Colorado Enterprise Zone (EZ) Program is designed to promote a business-friendly environment by offering state income tax credits. Taxpayers investing in Enterprise Zones can earn a credit on their Colorado income tax by planning and executing specific economic development activities. Some of these credits can be carried over for up to 5 years in certain cases.

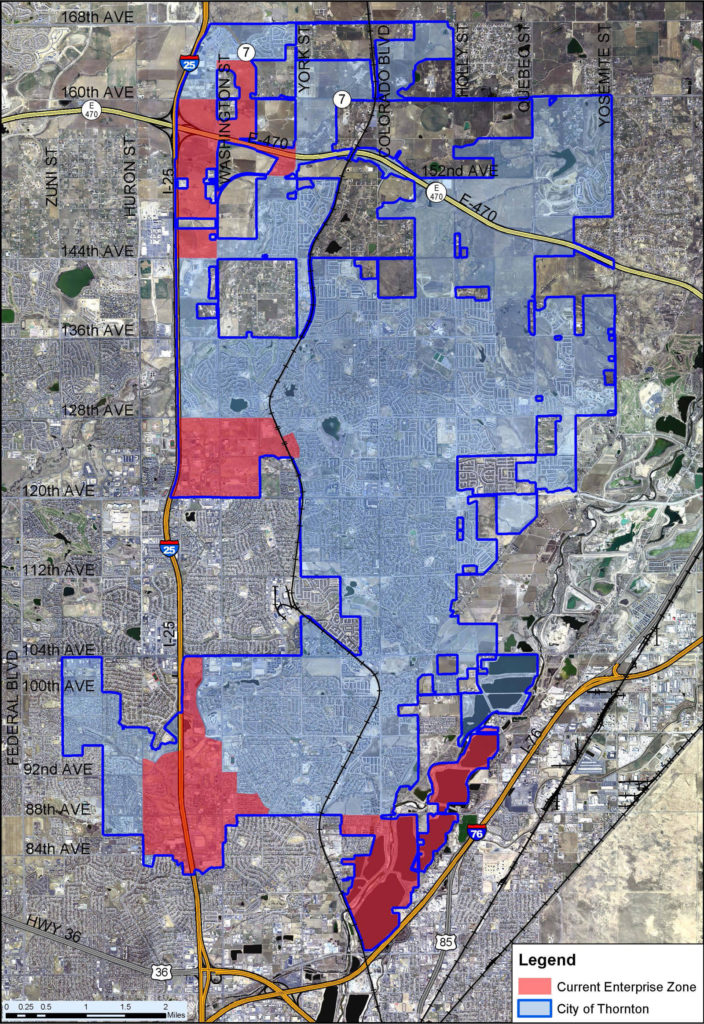

To take advantage of these credits you must be located in a State Enterprise Zone. Confirm your location in an Enterprise Zone, pre-certify, and begin receiving tax credits by visiting oedit.colorado.gov/enterprise-zone-program. Pre-certification takes less than 10 minutes!

Enterprise Tax Credits May Include:

- Investment Tax Credit: Providing businesses a tax credit of 3% for equipment purchases.

- New Employee Credit: A tax credit offering businesses $1,100 per new job created.

- Health Insurance: Offers businesses $1,000 per insured job. Available for the first two years in a State Enterprise Zone.

- Job Training: Companies implementing a qualified job-training program for their employees may claim an income tax credit of 12% of their eligible training costs.

- Research and Development Tax Credit: A tax credit of up to 3% for businesses, depending on the increase of a company’s research and development expenditures within an Enterprise Zone during the previous two income tax years.

- Commercial Vehicle Investment Tax Credit: Offers businesses a state income tax credit of up to 1.5% on commercial trucks, truck tractors, tractors, or semitrailers, as well as associated parts.

- Vacant Building Rehab: Allows owners or tenants of a building that is located in an Enterprise Zone, is at least 20 years old, and has been completely vacant for at least two years to claim a tax credit of 25% of the cost (up to $50,000) for rehabilitating the building for commercial use.

- Manufacturing/Mining Sales and Use Tax Exemption: A tax credit that expands on the Sales and Use Tax exemption offered by the State.

Enterprise Zone Fact Sheet

We’ve prepared a simple two-page fact sheet for easy digital distribution or printing. Click the button at right to download.